![AmtrakCreditCards Amtrak Guest Rewards credit card]()

Bank of America has recently unveiled their new Amtrak branded credit cards: Amtrak Guest Rewards World MasterCard and Amtrak Guest Rewards Platinum MasterCard. Are they worth applying for? Are they worth using? Are they worth keeping? Answers follow…

Basics

World MasterCard

Annual Fee: $79

Standard signup bonus: 20,000 points after $1,000 spend in 3 months

Earning rate: 3X Amtrak, 2X qualifying travel, 1X elsewhere

Big spend bonus: Earn 1,000 Tier Qualifying Points towards earning status for each $5K spent in a calendar year. Limit 4,000 TQPs per year. Cardholders also get the ability to transfer up to 25,000 points to hotels (3 Choice points per Amtrak point, or 2 Hilton points per Amtrak point) after $20,000 calendar year spend.

Noteworthy Perks: 5% Amtrak Guest Rewards point rebate on redemptions. Complimentary companion coupon, One-Class Upgrade and a single-day Club Acela pass each year. No foreign transaction fees.

Platinum MasterCard

No Annual Fee

Standard signup bonus: 12,000 points after $1,000 spend in 3 months

Earning rate: 2X Amtrak, 1X elsewhere

Noteworthy Perks: 5% Amtrak Guest Rewards point rebate on redemptions. No foreign transaction fees.

Amtrak Guest Rewards points

Both cards earn Amtrak Guest Rewards points. As of January 24, 2016, points will be worth 2.6 cents each for Acela routes (for fares of $100 or more) and 2.9 cents each elsewhere (for fares of $23 or more).

Are the cards worth applying for?

Quick answer: Yes

12,000 to 20,000 point signup bonuses don’t sound impressive, but with Amtrak’s new program, points are worth up to 2.9 cents each. So, the 12,000 point bonus can be worth up to $348 of Amtrak travel, and the 20,000 point bonus can be worth up to $580. While those numbers aren’t off the charts, they’re pretty good!

In addition to signup bonuses, cardholders of both cards get a 5% rebate on awards. Obviously, the more points you redeem while being a cardholder, the more valuable this particular perk becomes.

With the $79 World MasterCard, you also get a complimentary companion coupon valid for paid one-way or round-trip travel. And, you get a One-Class Upgrade Coupon valid only from Coach to Business class, or from Acela Business class to Acela First class, on a single travel segment or leg.

Are the cards worth using for spend?

Quick answer: Only under very specific circumstances

World MasterCard Earning rate: 3X Amtrak, 2X qualifying travel, 1X elsewhere

Platinum MasterCard Earning rate: 2X Amtrak, 1X elsewhere

At the time of this writing, premium cards from Chase (Sapphire Preferred and Ink Plus, for example) have the ability to transfer points to Amtrak 1 to 1. Similarly, members of the Starwood Preferred Guest (SPG) program can transfer points to Amtrak 1 to 1. So, cardholders of SPG cards, Chase Sapphire Preferred, and Chase Ink Plus would do better using those cards for non-bonus spend than to use the Amtrak cards. Either way, cardholders will earn one point per dollar, but Chase Ultimate Rewards points and SPG points are more valuable because they have many additional valuable uses besides transferring to Amtrak.

If you don’t have or want the Chase or SPG cards, then putting non-bonus spend on Amtrak cards does make sense since points are worth up to 2.9 cents each towards Amtrak travel.

For spend on Amtrak itself, the Platinum card simply matches the 2 points per dollar offered by the Chase Sapphire Preferred card (for all travel), but the World MasterCard’s 3 points per dollar is very good. Those with the Citi ThankYou Premier card (which offers 3X for all travel purchases) might prefer to use that card for Amtrak spend, but most people would do well with the Amtrak World MasterCard.

For non-Amtrak travel spend, the World MasterCard offers 2 points per dollar. I would recommend using this card for non-Amtrak travel purchases only if you do not have a card offering better rewards for travel spend (e.g. Citi ThankYou Premier 3X, Chase Sapphire Preferred 2X, etc.).

Is the World MasterCard worth using for big spend?

The $79 World MasterCard offers a couple of perks for big spend:

- Earn 1,000 Tier Qualifying Points (TQPs) towards earning status for each $5K spent in a calendar year. Limit 4,000 TQPs per calendar year.

- Cardholders also get the ability to transfer up to 25,000 points to hotels (3 Choice points per Amtrak point, or 2 Hilton points per Amtrak point) after $20,000 calendar year spend.

Amtrak offers the following elite status tiers:

Since the World MasterCard gives you 1,000 TQPs for each $5,000 of spend — up to 4,000 QTPs – it’s possible to get within 1,000 TQPs of Select elite status through spend alone. $20,000 worth of spend within a calendar year will result in 4,000 TQPs. You would have to spend another $500 in Amtrak travel within the same year in order to reach that first tier of elite status (Amtrak travel earns 2 EQPs per dollar). Is it worth it?

Here are the elite status benefits as advertised by Amtrak:

![]()

Interestingly, the only really valuable perk I see is the ability to transfer points. Specifically, Select status gives members the ability to transfer up to 50,000 Amtrak points per year to hotel programs. Since points transfer 1 to 3 to Choice, that means the ability to get up to 150,000 Choice points.

With the same $20,000 of annual spend on the card, cardholders are given the ability to transfer up to 25,000 points. So, the primary advantage of earning 1,000 additional EQPs through actual Amtrak travel (in order to achieve Select status) is the ability to transfer 50,000 points rather than 25,000 points. Those who are able to take good advantage of Choice points may find that well worthwhile.

Expert tip: it is very likely that there is a sneaky way to earn elite status through credit card spend alone. See this post for ideas.

Are the cards worth keeping?

No fee Platinum card: Yes. Keep for its 5% award rebate.

$79 World MasterCard: Keep if you get more than $79 value from its annual perks (companion coupon and upgrade certificate). Keep if used for its big spend benefits (ability to transfer points, progress towards elite status).

My best guess is that most people won’t get enough value from the World MasterCard to make it worth keeping after the first year. However, those who chase Amtrak status and those who highly value point transfers to Choice will do well with this card. My recommendation is to evaluate the benefits of the card when the second year annual fee comes due. If you do not feel that you are getting $79 in value, then consider cancelling the card, downgrading to the no fee Amtrak card, or product changing to a different no-fee card such as the Better Balance Rewards card.

The post Amtrak Guest Rewards credit card review appeared first on The Frequent Miler.

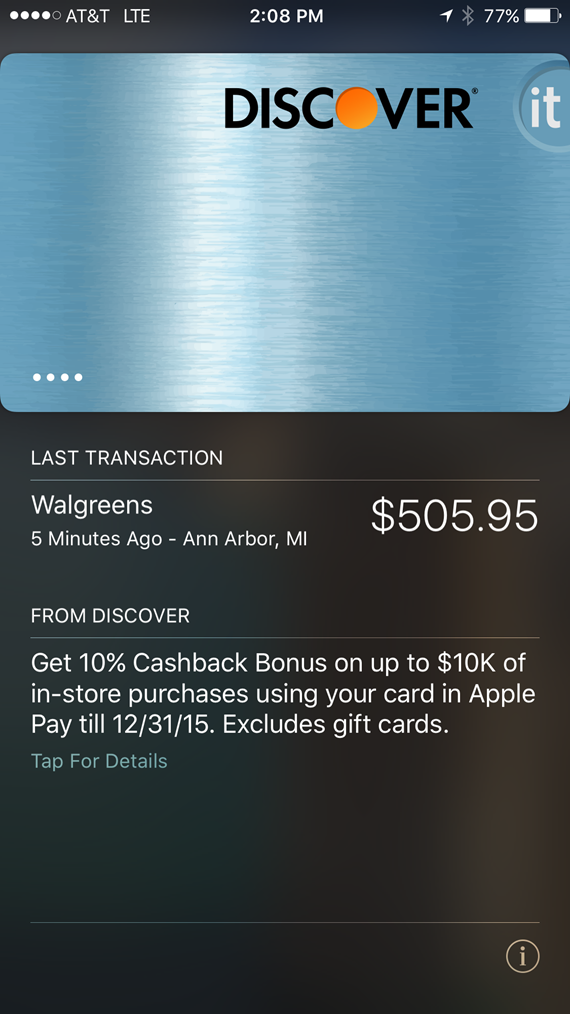

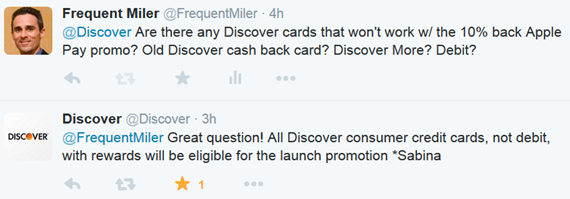

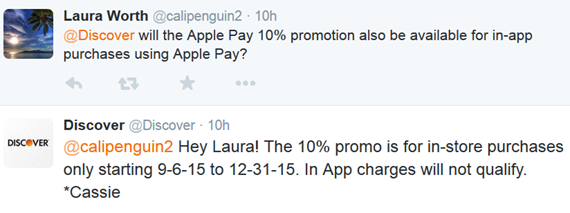

Discover’s top execs have gone completely crazy. Either that or their bonuses are dependent upon customer acquisition and retention and not on profit. Either way, it means free money for us. A lot of free money!

Discover’s top execs have gone completely crazy. Either that or their bonuses are dependent upon customer acquisition and retention and not on profit. Either way, it means free money for us. A lot of free money!

In my area, I found only Vanilla brand Visa or MasterCard gift cards. There are pros and cons to these cards.

In my area, I found only Vanilla brand Visa or MasterCard gift cards. There are pros and cons to these cards.